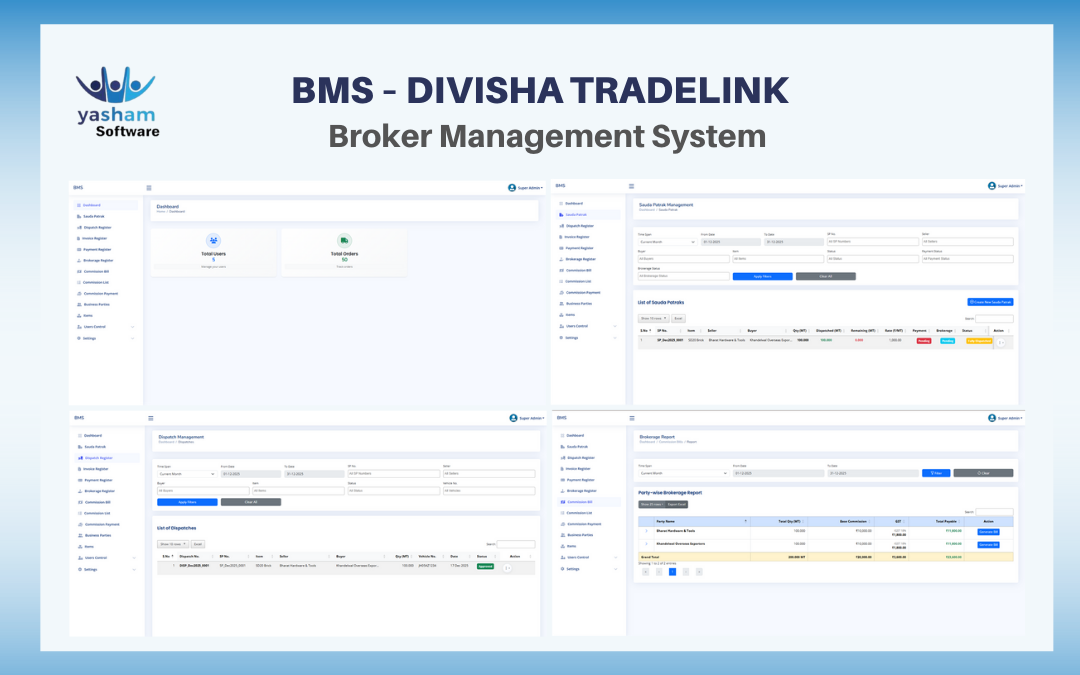

Client Overview

Client Name: Divisha Tradelink

Industry: Commodity Trading & Brokerage

Project Type: Broker Management System (BMS)

Core Purpose

High-volume commodity trading operations managed through brokers,

commissions, and multi-party settlements.

Overview

Divisha Tradelink manages complex trading workflows involving sauda (deal)

recording, dispatches, invoicing, brokerage calculation, commission settlement,

and payments. Prior to digitization, operations were heavily dependent on

manual registers and spreadsheets, resulting in reconciliation delays,

revenue leakage, and limited financial visibility.

Our team implemented a centralized

Broker Management System (BMS) to establish financial

control, brokerage transparency, and end-to-end operational discipline.

Project Objective

The objective of this project was to bring transparency and control to

brokerage-driven trading operations by:

- Centralizing sauda-to-payment transaction flow

- Automating brokerage and commission calculations

- Providing real-time visibility into broker-wise and party-wise profitability

- Reducing reconciliation effort during month-end closing

- Ensuring audit-ready transaction traceability

Challenges

Business Challenges

- Revenue leakage due to manual brokerage and commission handling

- No consolidated view of broker-wise or party-wise profitability

- Delays in commission settlement impacting broker trust

- Lack of real-time financial and performance visibility

Operational Challenges

- Separate manual registers for dispatch, invoice, payment, and brokerage

- No system-level linkage between Sauda, Dispatch, Invoice, and Commission

- Difficult reconciliation during month-end closures

- High dependency on individuals and spreadsheets

- Limited audit trail for disputes and corrections

Our Approach

Brokerage-Driven Trading System Design

We followed a structured ERP-style implementation approach tailored

for commodity trading and brokerage workflows.

Our approach included:

- Mapping end-to-end sauda, dispatch, invoicing, and commission processes

- Designing a centralized Broker Management System (BMS)

- Automating brokerage and commission logic based on defined rules

- Linking operational registers for full transaction traceability

- Implementing role-based access and audit-ready reporting

Services Delivered

- Centralized Broker Management System (BMS)

- Sauda Patrak for deal recording and rate finalization

- Dispatch Register linked with sauda and item details

- Invoice Register mapped to dispatch and brokerage logic

- Payment Register for party collections and settlements

- Brokerage Register with automated brokerage calculations

- Commission bill generation and tracking

- Commission list and commission payment management

- Business parties master (dealers, distributors, brokers)

- Items master for product-wise control

- Role-based user access and system governance

Key Functionalities

- End-to-end transaction flow:

Sauda Patrak → Dispatch → Invoice → Brokerage → Commission → Payment - Automated brokerage and commission computation based on defined rules

- Party-wise, broker-wise, and item-wise financial tracking

- Real-time visibility of pending vs paid commissions

- Centralized digital registers replacing manual books

- Role-based access for finance, operations, and admin users

- Historical data retention for audits and dispute resolution

Client Outcome

The BMS implementation eliminated manual brokerage errors and significantly

improved financial control.

Divisha Tradelink achieved faster reconciliations, transparent commission

tracking, improved broker confidence, reduced operational dependency on

individuals, and audit-ready transaction traceability across the entire

sales lifecycle.

Conclusion

The BMS – Divisha Tradelink project successfully transformed

a manual, register-driven trading operation into a centralized, transparent,

and scalable brokerage management system. By digitizing sauda-to-payment

workflows and automating commission logic, the solution delivered strong

financial governance, operational efficiency, and long-term scalability.